Vat 201 Form Download Sars

Shilpa is an Indian Tamil television actress known for her appearances in the mega-hit serials like Thangamana Purushan on Kalaignar TV, Life OK’s drama serial Savithri, and Kanmaniyae on Sun TV. TV Serial Actress. Tamil TV serial actress page. See more of TV Serial Actress on Facebook. Deivamagal Sun TV Serial Fans Club. Tamil serial actress list.

SARS eFiling is the official online tax returns submission portal for the launched originally in 2001 via third-party companies, then expanded and taken in-house by SARS in 2006. In the 2015/2016 tax year SARS eFiling processed 36.80 million electronic submissions and payments which equates to 98.7% of all submissions and payments to SARS in. SARS eFiling provides free services to individual taxpayers, trusts, companies and tax practitioners to submit tax returns, submit declarations and make relevant payments in an online environment.

The Turnover field figure is exclusive of VAT Other income sources e.g. Investment Income must not be included in this field No penalties will apply where turnover has been under estimated Further assistance and information Should you have any queries, please call the SARS Contact Centre on 0800 00 SARS (7277) or visit a SARS branch. Sars vat 201 form pdf VAT is an indirect tax on the consumption of goods and services in the. In order to register, an application form must be completed. All Forms: VAT119i - Indemnity iro VAT.

The eFiling service is of an international standard and is comparable to online tax submission services offered in the,,,,.

VAT201 eFiling user guide for Value-Added Tax CONTENTS 1. INTRODUCTION........2 2. REGISTERING FOR VAT.......2 3. REQUESTING VENDOR DECLARATION......5 4. COMPLETING THE VENDOR DECLARATION.....8 5.

SUBMITTING THE VAT201 DECLARATION FOR A SPECIFIC TAX PERIOD...18 6. MAKING PAYMENT........20 7.

MAKING ADDITIONAL PAYMENTS......24 8. REQUEST FOR CORRECTION.......25 9. SUBMITTING SUPPORTING DOCUMENTS......28 10. VIEWING HISTORIC DECLARATIONS......32 11. REQUESTING STATEMENT OF ACCOUNT (VATSA).....32 1. INTRODUCTION Since 2007, the South African Revenue Service (SARS) has been modernising and simplifying tax processes in line with international best practice. Improvements are being made continuously as we aim to better our service standards and increase efficiency and compliance.

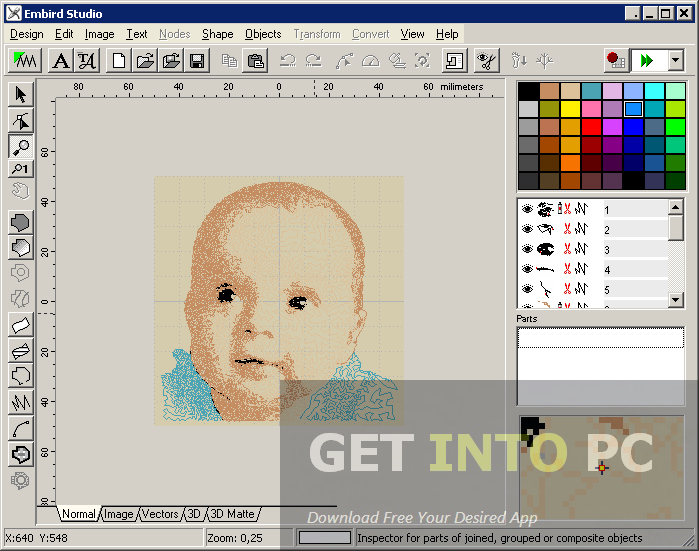

When you search for files (video, music, software, documents etc), you will always find high-quality pe design 10 serial activation files recently uploaded on DownloadJoy or other most popular shared hosts.  If search results are not what you looking for please give us feedback on where we can/or should improve. With our unique approach to crawling we index shared files withing hours after Upload.

If search results are not what you looking for please give us feedback on where we can/or should improve. With our unique approach to crawling we index shared files withing hours after Upload.

One of the aspects of compliance that SARS wishes to address is the declaration and payment of Value-Added Tax (VAT). During 2010 SARS announced that certain changes will be made to the VAT Vendor Declaration Form (VAT201 Declaration) aimed not only at improving systems processing but also at addressing SARS’s efficiency regarding risk assessment and tax compliance.

The following changes apply effective April 2011: • A new VAT201 Declaration form in landscape format has been introduced. It contains the same fields as the previous VAT201 form but with the following additional fields: ◆◆ Demographic information ◆◆ The declarant’s signature ◆◆ A Payment Reference Number (PRN) which will be pre-populated by SARS will replace the previous “reference number” This guide is designed to help you complete your VAT201 Declaration accurately and honestly. Note: The words declaration and return are used interchangeably in the document but both refer to the VAT201 Declaration. REGISTERING FOR VAT A vendor has to be registered as an eFiler to be able to register for VAT on eFiling.

• This will apply to: ◆◆ Individuals ◆◆ Tax practitioners ◆◆ Organisations (e.g. Companies, Close Corporations, Trusts and Exempt Institutions) To register for VAT on eFiling follow the steps below: Step 1 Navigate to www.sarsefiling.co.za Click on LOGIN Log in with your Log in name and Password 2 Step 2 Company Company, A ACompany123 Company 2001/123456/12 Once logged into eFiling, select “Organisation Tax Types” from the side menu options under ORGANISATION. Step 3 Company Tick the “VAT201” box to register for VAT, and fill in your VAT Reference Number and the Tax Office in the space provided. Note: Please note that once the vendor has registered for VAT on eFiling, no debit order payments will be allowed.